Fund of Funds

The best way for investors to gain a balanced exposure to Venture Capital

Why Fund of Funds?

Dedicated team

- >Focus on one thing and one thing only: picking the best-in-class funds & co-investment opportunities

- >Long-standing relationships with top tier industry players across Latam, including under the radar managers

Balanced exposure

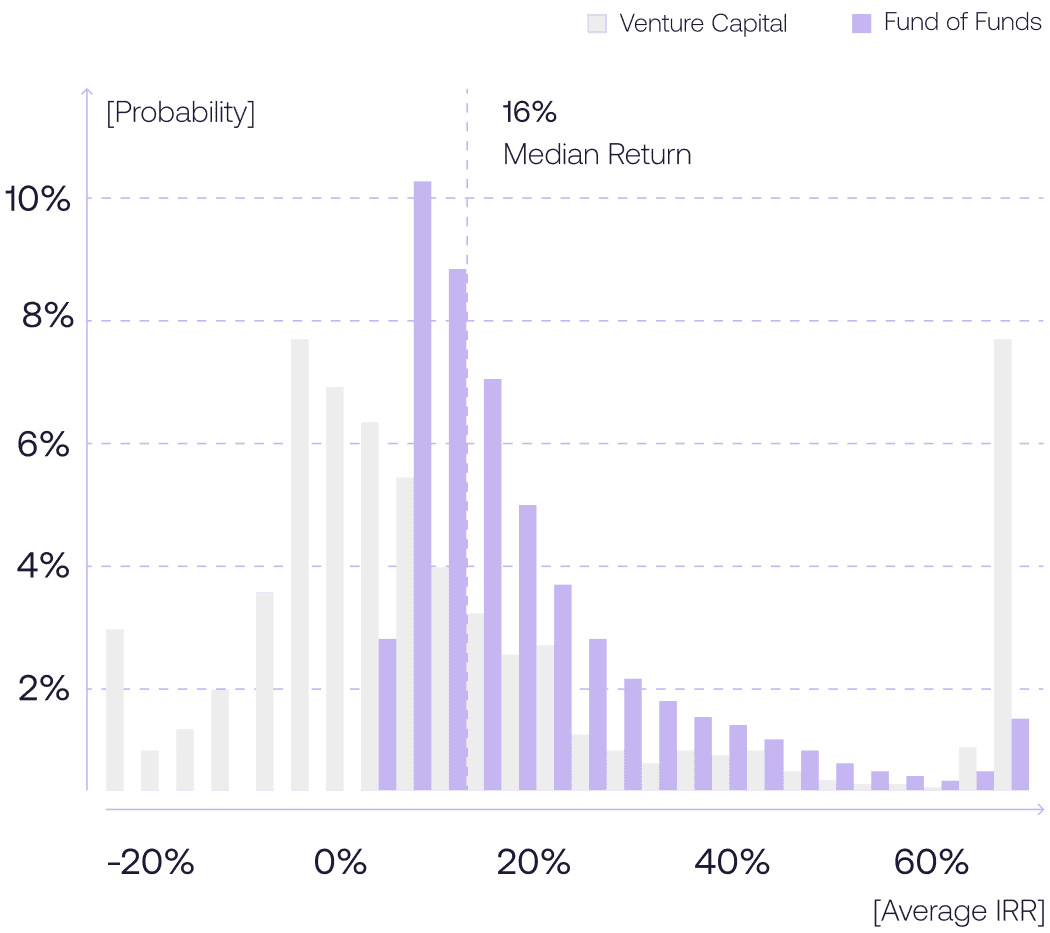

- >Diversification is the name of the game: we invest in different managers' maturity across multiple vintages, geographies, sectors and funding stages.

- >Greater downside protection in adverse scenarios

Access

- >Majority of value created by VC industry comes from handful of companies, which are consistently backed by a small group of top-tier VCs

- >VC Fund performance dispersion is huge! It is essential to pick top quartile managers

- >Excessively high minimum investment ticket size renders access to top-notch funds unattainable for some investors

Smart

Diversification

Smart Diversification

Access to under-the-radar funds and exposure to different and complementary VC strategies

02 /Co-investment opportunities alongside top-tier investors

03 /Combining the potential return of the early-stage with the downside protection from growth-stage investing

Investment

Pipeline

Investment Pipeline

01/

Proactive coverage of the ecosystem

02/

Constant touchpoints to evaluate key issues and portfolio evolution

03/

Volume of evaluated opportunities allows for pattern matching

Venture Capital is a must-have in any forward-looking investment porfolio

[Invested Managers and Companies]